“Windfarm on Oahu’s north shore. As soon as we started shooting, the wind stopped.” from janewells [CNBC, Hawaii] http://twitpic.com/45rh6rRenewable energy has a problem in reliability. We all know the wind doesn’t blow all the time and the sun doesn’t shine 24/7, and that’s a fact of nature. If wind and solar power are to break out and become significant sources of electricity, changes are needed to improve the way we deal with that variability. Wind and solar power, as we’ll see, need backup batteries.

Minor Role Players

In what is probably a familiar pie chart by now, coal, natural gas and nuclear currently provide 90% of U.S. electricity. The remaining 10% is from renewable sources, of which one source, hydroelectric, makes up two-thirds. The remaining renewable sources in the “other” category are wind and biomass, with minor contributions from solar and geothermal. In total, wind and solar power are less than 2% of the total electricity pie. Despite all the news and interest in renewable energy, wind and solar power have a long way to go to become significant sources of electricity.

|

| from EIA: 2009 U.S. Electricity by Source |

Focus on Wind and Solar

Whenever renewable energy is mentioned, wind and solar usually get the attention over the other sources, hydroelectric, biomass, and geothermal. As generating sources of electricity, hydroelectric, biomass, and geothermal are all more continuous, and therefore more reliable.

Part of the reason appears to be psychological. What, after all, could be more clean and natural than the wind and the sun. Biomass still comes down to burning a fuel; geothermal development involves drilling, which makes it look like a cousin to the oil and gas industry; and hydroelectric power comes from what used to be a very dirty word, dams.

The other part is growth. Wind and solar installations provide faster construction, are scalable, and typically don’t have the permitting battles that, in most cases, are associated with biomass or hydroelectric. Wind and solar projects also don’t carry the development risk and regional limitations that can be associated with geothermal power.

This ability for rapid growth is seen in wind power. In the last 5 years, the generating capacity from wind power in the U.S. has grown by about 400% to about 40 GW. To put that in perspective, the total generating capacity from all nuclear plants in the U.S., 104 of them, is about 100 GW.

Part of the reason appears to be psychological. What, after all, could be more clean and natural than the wind and the sun. Biomass still comes down to burning a fuel; geothermal development involves drilling, which makes it look like a cousin to the oil and gas industry; and hydroelectric power comes from what used to be a very dirty word, dams.

The other part is growth. Wind and solar installations provide faster construction, are scalable, and typically don’t have the permitting battles that, in most cases, are associated with biomass or hydroelectric. Wind and solar projects also don’t carry the development risk and regional limitations that can be associated with geothermal power.

This ability for rapid growth is seen in wind power. In the last 5 years, the generating capacity from wind power in the U.S. has grown by about 400% to about 40 GW. To put that in perspective, the total generating capacity from all nuclear plants in the U.S., 104 of them, is about 100 GW.

Hitting A Wall

The problem with wind power is that 40 GW is in generating capacity, not actual generation. Because of its variability, wind power produces less than 2% of our electricity. Nuclear power, with 100 GW in generating capacity, produces about 20%. It should be no surprise, then, that nuclear power fills a role as a steady provider of base loads. Wind power, as it stands, does not fit well into either base load or peaking power.

The problem can be found summed up in a report on California Renewable Portfolio Standards [1]:

The problem with wind power is that 40 GW is in generating capacity, not actual generation. Because of its variability, wind power produces less than 2% of our electricity. Nuclear power, with 100 GW in generating capacity, produces about 20%. It should be no surprise, then, that nuclear power fills a role as a steady provider of base loads. Wind power, as it stands, does not fit well into either base load or peaking power.

The problem can be found summed up in a report on California Renewable Portfolio Standards [1]:

Historically, given its variable nature, wind generation has been taken on an as-available (or “must take”) basis, and grid operators compensate by incrementing or decrementing the output of other committed generation. At low wind penetrations, such actions do not significantly affect system operations. At higher levels of wind penetration, however, forecast uncertainty becomes more challenging.

The problem is not as bad for solar power, which has the advantage of being there at the same time additional power is needed in the grid for cooling. At present, however, solar rates as the highest cost of all forms of energy, double that of wind power, as ranked in a recent issue of Smart Money.

The EIA also sees the problem as one of cost.

Resources are Resources

The EIA also sees the problem as one of cost.

1. Renewable Energy Technologies Are Capital-Intensive: Renewable energy power plants are generally more expensive to build and to operate than coal and natural gas plants. Recently, however, some wind-generating plants have proven to be economically feasible in areas with good wind resources, compared with other conventional technologies.

2. Renewable Resources Are Often Geographically Remote: The best renewable resources are often available only in remote areas, so building transmission lines to deliver power to large metropolitan areas is expensive.

[from EIA website: Why We Don’t Use More Renewable Energy]The combination of cost and penetration is seen in EIA’s forecasts. By 2035, wind and solar power are projected to grow to about 60 GW in capacity, this out of total generating capacity in the U.S. of 1,110 GW. Unless there are changes, wind and solar will continue to be small slices in the energy pie.

Resources are Resources

So, with such a negative outlook, why even worry about wind and solar? Politics is one reason. Renewable Portfolio Standards in some form have been legislated in 35 states, and, with rising oil prices, efforts to regulates carbon, coal ash, and hydrofracing for natural gas, and concerns over nuclear power, we can count on more money going into renewable energy. Another reason is change in economics. Costs change as technology improves, so ignoring a resource on the basis of current economic conditions can be short sighted. Canada’s oil sands are a prime example of a resource that some thought would never be economic.

So Why Batteries?

From reading papers on California’s RPS website, one doesn’t have to be a power engineer to see that, at even low levels of “penetration”, variability is a problem. Utilities need to be able to fill in the gaps in generation from wind and solar. We can think of this as adding batteries to store up energy as it is being generated for later use. We can also try to fill in the gaps by bringing in electricity from elsewhere. In the latter case, we look for improvements in transmission, deferrable loads, energy saving devices, and the Smart Grid to lead the way. As it stands now, the burden of leveling out wind and solar power lies with the sources of peaking power, hydroelectric and natural gas.

So Why Batteries?

From reading papers on California’s RPS website, one doesn’t have to be a power engineer to see that, at even low levels of “penetration”, variability is a problem. Utilities need to be able to fill in the gaps in generation from wind and solar. We can think of this as adding batteries to store up energy as it is being generated for later use. We can also try to fill in the gaps by bringing in electricity from elsewhere. In the latter case, we look for improvements in transmission, deferrable loads, energy saving devices, and the Smart Grid to lead the way. As it stands now, the burden of leveling out wind and solar power lies with the sources of peaking power, hydroelectric and natural gas.

Physical Storage

A good overview can be had from papers in the DOE’s Energy Storage Systems Conference from November, 2010 [2].

Storage systems vary in output and capacity. At the small end of the scale are actual batteries, such as lithium ion or sodium sulfide batteries, which have potential for use in households and small utilities, up to about 10 MW. Above that, at the larger scale that would support a large wind farm or solar field, three approaches appear to be emerging so far: 1) pumped storage; 2) compressed air energy storage, or CAES for short; and 3) molten salt.

Pumped Storage

The idea of pumping water up to a reservoir for later use is not new. There are 18 reservoirs in the U.S. that function as pumped storage, the earliest being built in the 1960’s and the most recent in 1995. Together, they have total generating capacity of 22 GW, which compares to total hydroelectric capacity in the U.S of 77 GW. [3,4]

The obstacles to new projects are high construction costs and environmental impacts. An article in NY Times [5] notes that pumped storage projects today take five years to permit, another five years to build, and cost up to $2 billion for a 1 GW facility.

|

| from tva.gov: Pumped Storage at Racoon Mountain |

Compressed Air Energy Storage (CAES)

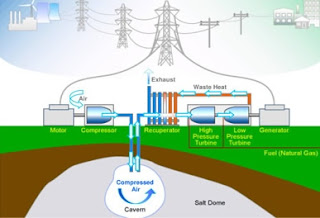

As anyone who owns a shop compressor knows, you can store energy in a compressed air tank too. The idea of doing it on a large scale, using an underground cavern for the storage tank, is also not new. Two large-scale CAES plants operate in the world, a 290 MW plant in Germany, built in 1978, and 110 MW plant in Alabama, built in 1991. At least 3 more plants are planned, including a 270 MW project in Iowa, a 150 MW project in New York, and another plant in Germany. [6]

To operate, CAES plants reheat the air in natural gas burners before generating electricity via turbines. Efficiency is a problem as about 1 unit of energy is needed from natural gas for every 2 units of energy generated. Current research is focusing on plants that don’t use natural gas for reheating, thereby eliminating the criticisms over efficiency and use of hydrocarbons.

|

| From nrel.gov [7] CAES Plant |

Molten Salt

One other way of storing energy on a large scale is through heat, in this case, by melting salt. Unlike pumped storage or compressed air, storage using molten salt is more restricted by time. The process is thermal, so it’s a natural fit for solar energy using mirrors in concentrating solar plants. One being built in Arizona is the $500 million Crossroads Solar Energy Project, a 150 MW plant with 10 hours of storage time. [8,9]

The Winner Is

... too early to tell. In construction cost, the advantage at present goes to compressed air, at about $700/KW, versus $1,000/KW to $2,000/KW for pumped storage, and $3,300/KW for molten salt [10]. Combined with operating costs and energy losses, all three systems can cost more than what utilities are able to charge for electricity, but negative revenues for storage may be the price tag for bringing more wind and solar power onto the grid.

The idea is also out there that the balancing for more wind and solar power can be achieved through existing hydroelectric, by upgrading transmission through new power lines and Smart Grid technologies. The difficulty is this is a lot easier to talk about than actually do given the permitting and land issues that come with building new transmission lines.

In the end, the best friend to wind and solar power could turn out not to be storage or better transmission, but more local generation from natural gas, a fact that may be getting lost in the ongoing turf war between industry groups and their supporters. One thing for sure is the U.S. needs more electricity, and changes are needed to get it. How we get there depends on how the wind blows, politically and economically speaking that is.

[8] http://www.solarpowerengineering.com/2011/02/arizona-uses-molten-salt-for-storage/